Here’s what you could be doing if you, like so many others, are struggling financially.

If you’re a beauty or aesthetics business owner, one of your primary stressors right now is undoubtedly managing cash flow, and dealing with your ongoing overheads alongside massive losses incurred by your closure. Thankfully, the Australian government is doing its part to alleviate some of the strain on small businesses, and these new financial support schemes and introductions to legislation will hopefully play a large role in getting you through this difficult year. Here’s a round up of changes in legislation you need to know, plus some additional expert advice, that may help you reduce your overheads and manage your cashflow during the Covid 19 crisis.

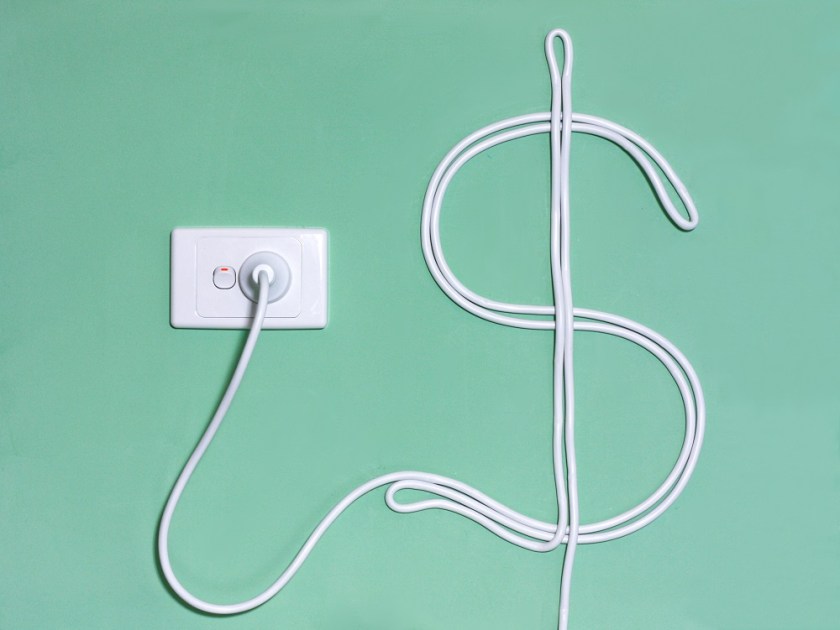

1. Seek help with energy bills

Did you know that the government has stepped in to help business owners with their energy bills? According to business.gov.au – if you can’t pay your bill on time or you’ve received a disconnection notice, contact your retailer. The Australian Government wants energy companies to look after businesses and other customers affected by coronavirus, and have set some expectations of energy providers including waiving disconnection, re-connection and/or contract break fees for small businesses that have gone into hibernation, along with daily supply charges to retailers, during any period of disconnection until at least 31 July 2020, offering all households and small businesses in financial stress a payment plan or hardship arrangement, not disconnecting customers who may be in financial stress, deferring referral to debt collection agencies, and minimising planned outages. If you’re not satisfied after speaking to your retailer, contact the energy ombudsman in your state or territory. An ombudsman is a free and independent dispute resolution service.

2. Request a special rental arrangement

The Government has announced a range of measures to help renters. According to business.gov.au – this includes a temporary hold on evictions and a mandatory code of conduct for commercial tenancies to support small and medium sized enterprises (SMEs) affected by coronavirus. A mandatory code of conduct outlines a set of good faith leasing principles for commercial tenancies including retail, office and industrial, between: owners, operators, other landlords and tenants. This code applies to tenants that are a small to medium sized business with an annual turnover of up to $50 million. Rent reductions will be based on the tenant’s decline in turnover to ensure that the burden is shared between landlords and tenants. The code includes a common set of 14 principles. These include that:

- landlords must not terminate leases for non-payment of rent during the COVID-19 pandemic (or reasonable recovery period)

- tenants must stay committed to their lease terms (subject to amendments)

- landlords must offer reductions in rent (as waivers or deferrals) based on the tenant’s reduction in trade during COVID-19

- benefits that owners get for their properties (e.g. reduced charges, land tax, deferred loan payments) should be passed on to the tenant (in the appropriate proportion)

Accounting service MYOB has also weighed in with some strategies on managing cash flow during these difficult months ahead:

3. Review your delivery costs

Right now, one of your main focuses is likely to be retail sales, and turning over your existing stock through (for most beauty and aesthetic businesses) an online store. Consider whether you’re being as frugal as possible when it comes to delivery, as this can really add up for some small businesses. Are you charging enough for shipping to cover your costs, or does this require some consideration? Are a large portion of your clientele local enough that hand-delivering would be worth your while? Or could you introduce a pick-up option?

4. Consider alternate revenue streams

Businesses have a choice right now – either shut down, or evolve and keep operating. If you haven’t already, consider if you have the capacity to introduce some new revenue streams and offerings, from online consults and workshops to retail and deliveries. Here are some examples of how businesses are coping with the change.

5. Consult the ATO

The ATO has announced support measures for businesses impacted by COVID-19, which includes payment deferrals, changing quarterly GST reporting cycle to monthly reporting to get quicker access to GST refunds, and varying PAYG quarterly tax instalments, plus allowing businesses to accelerate their depreciation deductions on the purchase of certain new depreciable assets. Here’s everything you need to know as a business/employer.

6. Take advantage of government support

Be sure to take advantage of the government’s various stimulus packages (such as Job Keeper or support for sole traders), and seek financial advice on whether there is a scheme suited to your individual circumstances.